Popular commodities

Trade popular commodities such as Natural Gas or Crude Oil, as well as lesser-traded commodities like sugar and cocoa.

*The swap value depends mainly on the level of interest rates and the commission of the Company for rolling an open position during midnight. The swap is automatically converted to the base currency of the trading account of the client. The Company reserves the right to amend the swap values of a specific client in case of suspicion for trading abuse. The operation is carried out at 23.59 (server time) and may take several minutes

**The above spreads are indicative and applicable under normal trading conditions during day trading sessions. There may be instances when market conditions cause spreads to widen beyond the typical average spreads displayed above.

To view real time values clients should refer to their client terminal.

Trade a wide range of spot commodities, including crude oil, coffee and sugar with CFDs.

You can explore the commodities market with low margin, flexible leverage and low commission.

Trade popular commodities such as Natural Gas or Crude Oil, as well as lesser-traded commodities like sugar and cocoa.

Trade all hours of the day, whenever it is convenient for you, and grasp opportunities when you want.

Whether markets are falling or rising, you can trade both directions by buying (going long) or selling (going short) your favourite commodities.

Enjoy the support you need any time you need it, 24 hours a day, 5 days a week.

Manage your costs with our ultra-thin spreads.

All trading involves risk. It is possible to lose all your capital.

Commodity prices are influenced by fundamental factors including supply and demand, economic growth, geopolitical tensions and government policies.

Commodity prices tend to rise due to increasing demand and a diminishing overall supply. However, when there is a decreasing demand and increasing supply, the price of a commodity is going to decrease.

Commodities are usually priced in a global currency such as the US dollar, so any fluctuation in the USD will impact commodity prices. A stronger currency can increase the price of commodities in other currencies, potentially reducing demand and affecting prices.

If the economy is expanding, consumers are spending more, and the government is enacting policies that attract investments in specific commodities. The demand for those commodities will increase, and their prices will rise.

Political events, such as wars, sanctions, and government policies regarding commodities can create volatility in commodity prices.

All trading involves risk. It is possible to lose all your capital.

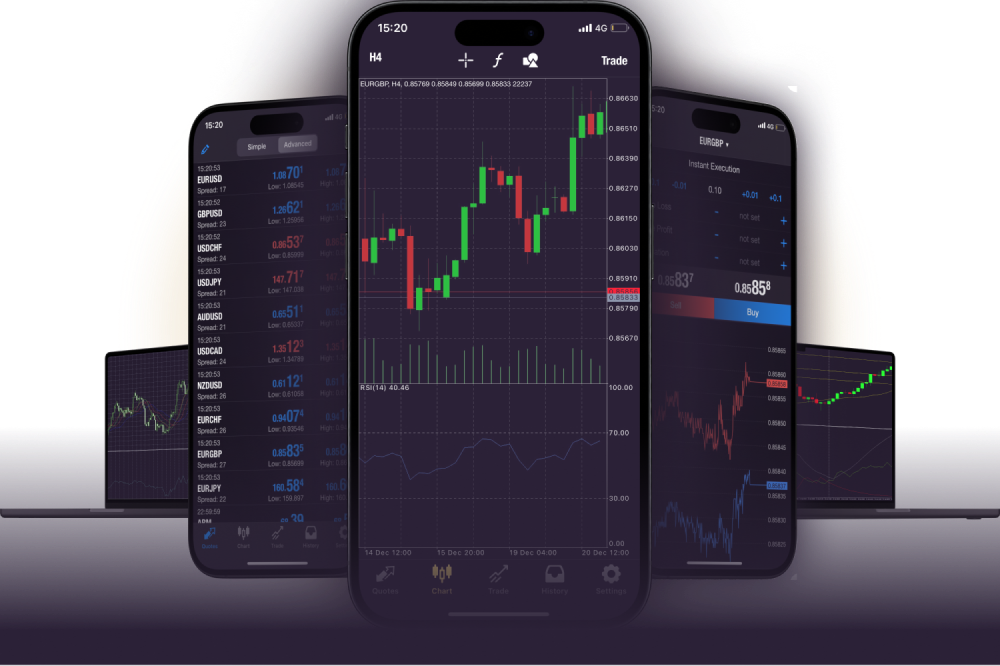

Empower your trading and grasp market opportunities with the world’s number 1 online trading platform.

Trade CFDs on commodities on the MT4 platform and access advanced charting and indicators.

Trade seamlessly online without the need to download any software

Xlence, with registered address F20, 1st Floor, Eden Plaza, Eden Island, Seychelles, is a trade name of Tradeco Limited. Tradeco Limited is authorised and regulated by the Seychelles Financial Services Authority with licence number SD029.

Damadah Holding Limited, with registered address of 365 Agiou Andreou, Efstathiou Court, Flat 201, 3035 Limassol, Cyprus, facilitates services to Tradeco Limited, including but not limited to payment services.

Risk Warning: Our products are traded on margin and carry a high level of risk and it is possible to lose all your capital. These products may not be suitable for everyone, you should ensure that you understand the risks involved.

Xlence does not offer its services to residents of certain jurisdictions such as USA, Iran, Cuba, Sudan, Syria and North Korea.

This website is not intended for UK residents, nor is it bound by the MiFID II regulatory framework or by the rules, guidance and protections set out in the UK Financial Conduct Authority Handbook.

If you still wish to access Xlence, please click below.

This website is not aimed at individuals residing in the EU and is not subject to European and MiFID II regulations.

If you still want to proceed to Xlence, please click below.