The Head and Shoulders Pattern

The Head and Shoulders pattern is widely recognised as a prominent reversal formation in technical

analysis. When a price trend is undergoing reversal from either a bullish or bearish direction on a chart,

this distinctive pattern emerges.

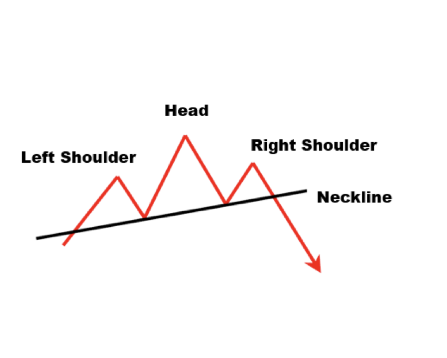

In a Head and Shoulders Top formation, the pattern consists of three main components: a left

shoulder, a head, and a right shoulder, delineated by a neckline.

The left shoulder forms at the end of a significant upward movement, often accompanied by high

trading volume. Following the peak of the left shoulder, prices experience a corrective decline on

relatively low volume. Subsequently, prices rally again to form the head, typically accompanied by

normal to heavy trading volume. The subsequent decline from the head is usually on lower volume.

The right shoulder forms as prices rise once more but fail to exceed the high of the head, remaining

below the peak of the head and falling nearly to the level of the low point between the left shoulder

and the head, or at least below the peak of the left shoulder. Volume during the formation of the right

shoulder is generally lower compared to both the left shoulder and the head.

A neckline is drawn across the lows of the left shoulder, the head, and the right shoulder. Confirmation

of the Head and Shoulders Top formation occurs when prices break below this neckline after forming

the right shoulder. It is common for prices to retest the neckline before continuing their downward

trend.

Inverted Head and Shoulders

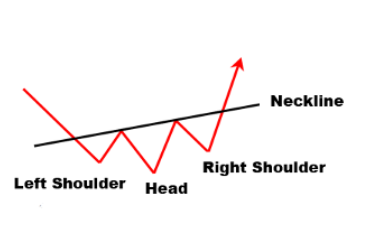

The Inverted Head and Shoulders pattern is essentially the opposite of a Head and Shoulders Top,

often signalling a shift in trend and sentiment. This formation appears upside down on a chart and

exhibits a different volume pattern compared to a Head and Shoulders Top.

Prices initially decline to form the first low, accompanied by increased volume, marking the

completion of the left shoulder. Subsequently, prices drop further to a new low. A recovery phase

follows, characterized by relatively higher volume than seen previously, completing the head

formation. A corrective pullback on lower volume then begins to form the right shoulder. The pattern

is finalized with a strong upward movement on heavy volume, breaking through the neckline.

Unlike Head and Shoulders Top formations that typically complete within a few weeks, a major

Inverted Head and Shoulders (including the left shoulder, head, and right shoulder) often takes longer,

spanning several months or even more than a year.

The neckline drawn across the lows of the left shoulder, head, and right shoulder serves as a crucial

support level. Confirmation of the Inverted Head and Shoulders formation occurs when prices break

above this neckline, ideally on increased volume. However, it’s essential to note that a breakthrough

the neckline on significantly higher volume (more than three to four percent) should be monitored

closely, as it may indicate a significant market move.

Key Characteristics:

Inverted Head and Shoulders formations are often not perfectly symmetrical, tilting slightly upward

or downward.

One shoulder may appear lower than the other.

The time involved in forming valleys can cause one shoulder to appear broader than the other.

The neckline may not be perfectly horizontal; it could ascend or descend.

If the neckline is ascending, a key criterion is that the lowest point of the right shoulder must be

notably lower than the peak of the left shoulder.

Usage as a Tool:

After confirmation, the Inverted Head and Shoulders pattern is highly useful for estimating and

measuring the potential extent of the subsequent move from the neckline. Traders often measure the

distance from the head peak to the neckline and then project a similar distance upward from the

neckline after the right shoulder completes. This provides a minimum target for how far prices could

rise after the formation completes.