The Interplay of Monetary Policy, Inflation & Exchange Rates

Having gone through what impacts exchange rates in the last lesson, now we will see how

exchange rates are impacted by monetary policy. We will also learn what inflation is as well

as how it impacts monetary policy.

Monetary policy: Definition

Monetary policy involves the actions by a country’s central bank to control the economy’s

money supply.

Understanding inflation

The rate of general price increases for goods and services is known as inflation, and it is

usually measured annually, e.g., 5% year over year (yoy). Likewise, it can be evaluated on a

quarterly or monthly basis. In short, inflation is the progressive decrease in the purchasing

power of each unit of currency. A pen that costs 1 euro in 2021 will be worth 1.05 euros in

2022, for example, if inflation is 5% per year.

High inflation: What are its impacts?

Different groups are impacted by high inflation in different ways. In general, savers suffer

because their money depreciates. In the event of a 10% inflation rate, 100,000 euros will be

worth 10% less. On the other hand, it may help borrowers. In the event that inflation

increases by 10% and you have a mortgage of 100,000 euros, the value of your home

increases, but the amount of your loan does not.

The biggest risk is fluctuating inflation, which has the ability to discourage investment and

spending and even cause economic downturns.

To understand why it’s so important, it’s useful to examine its extreme forms, negative

inflation (deflation) or very high inflation (hyperinflation).

Deflation: As prices steadily decline, fewer people make purchases and the economy slows

down. A recession results from people delaying purchases because they anticipate price

reductions.

Hyperinflation: When prices rise so fast that there is no value to money. For example, in

2008, Zimbabwe’s inflation rate hit 231,000,000% yoy, making personal finance and

business planning almost unfeasible.

The role of central banks in managing inflation

Central banks aim to keep inflation low and stable at around 2% per year. How do they do

this? They typically cut interest rates to raise inflation when it drops below the 2% target, or

they increase interest rates to combat inflation when it surpasses 2%.

In the first scenario (deflation), the central bank encourages borrowing by lowering interest

rates. More economic activity, which is correlated with higher borrowing, typically results in

higher demand and ultimately higher prices overall, thus leads to a rise in inflation.

In the second scenario, the goal of the central bank is to increase interest rates in order to

to discourage consumers from borrowing excessively. Rising rates aim to act as a chokehold

on demand, which stifles spending and due to suppressed demand, prices are driven lower

and high inflation gets tamed.

All about interest rates & exchange rates

A currency typically strengthens in response to an increase in interest rates, whereas it

weakens as as a result of rate reductions.

Example:

When investors exchange their money for Australian dollars in response to an increase in

interest rates, the demand and value of AUD rises, as depositors are encouraged to keep

their money in the bank to capitalize on the interest payable. On the other hand, lowering

rates weakens the demand for AUD.

Examples of intervention

In critical situations, central banks may step in to stabilise the value of their currency.

Should the currency depreciate more than anticipated, it will purchase its own money by

selling its foreign reserves. They have a limited amount of inventory that they can sell

before running out, thus careful and mindful actions are taken by central banks when they

have no choice but to intervene.

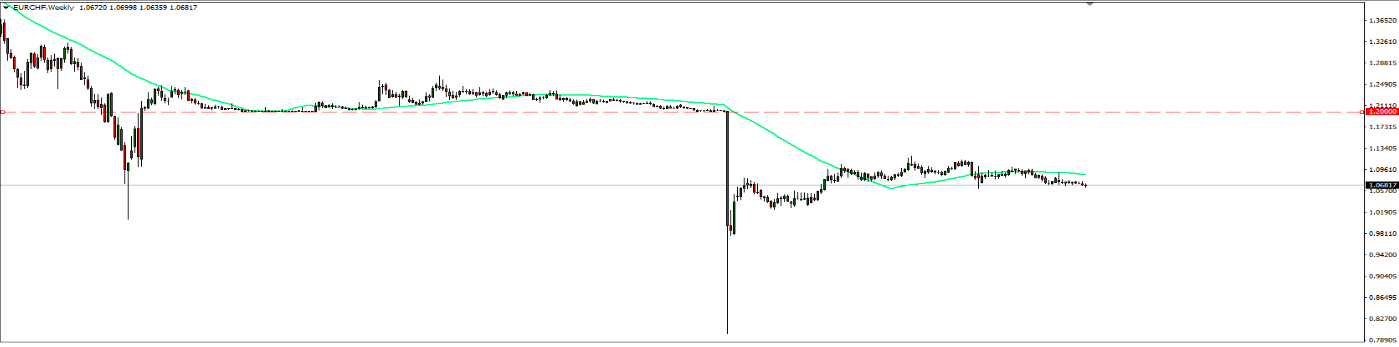

The Swiss National Bank, the People’s Bank of China and the Bank of Japan are prime

examples of central banks that conducted interventions in the FX market to stabilize their

currencies in recent years.

EUR/CHF floor and subsequent removal at the Swiss National Bank’s market intervention.

We hope you gained a better understanding of how inflation and monetary policy affect

exchange rates. In our next lesson, we’ll look at the relationship between monetary and

fiscal policy.