Uptrend, Downtrend and Sideways Trend

What is a Trend Line in Technical Analysis?

A trend line is formed by drawing a diagonal line between two or more price pivot points, commonly

used to determine entry and exit points when trading securities. It acts as a boundary for the price

movement of a security.

Support and Resistance Trend Lines

Support Trend Line: Formed when a security’s price decreases and rebounds at a pivot point aligning

with at least two previous support pivot points.

Resistance Trend Line: Formed when a security’s price increases and rebounds at a pivot point aligning

with at least two previous resistance pivot points.

Types of Trends

Uptrend

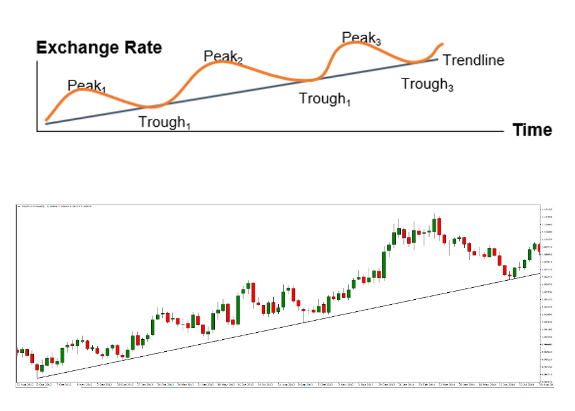

Definition: A series of consecutive higher peaks and higher troughs.

Construction: Connect two or more higher lows and extend the line into the future to act as support.

Signal: Indicates bullish sentiment, suggesting prices are likely to increase.

Strategy: Traders buy near the pullbacks to the trend line.

Example of an upward trend line:

The Downtrend

Definition: A series of consecutive lower peaks and lower troughs.

Construction: Connect two or more lower highs and extend the line into the future to act as resistance.

Signal: Indicates bearish sentiment, suggesting prices are likely to decrease.

Strategy: Traders sell near the corrective rebounds to the trend line.

The Sideways Trend

Definition: Identified by drawing two parallel trend lines, forming a trading range rectangle.

Behaviour: Prices trade horizontally with neither bulls nor bears in control.

Strategy: Traders buy near the lower end of the range and sell near the upper end.

Using Trend Lines

Trend lines are a simple and widely used technical analysis tool. They require historical data,

typically presented in chart form. While historically drawn by hand, modern charting software allows

for computer-based drawing, with some software automatically generating trend lines. Most

traders, however, prefer to draw their own.

- Chart Interval: Choose a chart based on an interval period aligning with your trading

strategy. Short-term traders use intervals like 1 minute, while long-term traders use hourly,

daily, weekly, or monthly intervals. - Application: Trend lines can be used on price charts and various technical analysis charts,

such as MACD and RSI, to identify positive and negative trends. - Positive Trend: Forms an upsloping line when support and resistance pivot points align.

- Negative Trend: Forms a downsloping line when support and resistance pivot points align.