Calculating Pivot Points

A pivot point is a pivotal price level in financial markets, widely used by traders to forecast potential

movements. It serves as a predictive indicator derived from significant market prices (high, low, close)

of the previous trading period. When the market trades above the pivot point in the subsequent

period, it typically signals bullish sentiment; conversely, trading below indicates bearish sentiment.

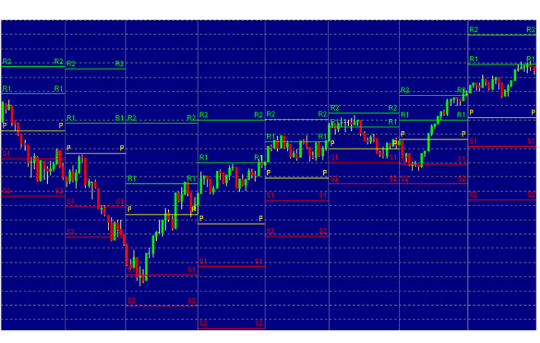

Monthly pivot point chart of the Dow Jones Industrial average for the first 8 months of 2009, showing

sets of first and second levels of resistance (green) and support (red). The pivot point levels are shown

in yellow. Trading below the pivot point, particularly at the beginning of a trading period sets a bearish

market sentiment and often results in further price decline while trading above it, bullish price action

may continue for some time.

Calculation of Pivot Points

Pivot points are calculated using various methods, with the most common being the arithmetic

average of the high (H), low (L), and closing (C) prices: P=(H+L+C)3P = \frac{(H + L + C)}{3}P=3(H+L+C)

Additional variations include incorporating the opening price of the current or previous periods:

- Including opening price (O): P=(O+H+L+C)4P = \frac{(O + H + L + C)}{4}P=4(O+H+L+C)

- Emphasizing closing price: P=(H+L+C+C)4P = \frac{(H + L + C + C)}{4}P=4(H+L+C+C)

- Focusing on current period’s opening price: P=(H+L+O+O)4P = \frac{(H + L + O + O)}{4}P=4(H+L+O+O)

Support and Resistance Levels

Support and resistance levels derived from pivot points play crucial roles in technical analysis:

- Support Levels: Levels below the pivot point indicate potential price floors during

downtrends. - Resistance Levels: Levels above the pivot point act as price ceilings during uptrends

Calculation of Support and Resistance Levels

Several support (S) and resistance (R) levels are typically calculated:

- First Set (S1 and R1): Derived from half of the trading range around the pivot point:

- R1=2×P−LR1 = 2 \times P – LR1=2×P−L

- S1=2×P−HS1 = 2 \times P – HS1=2×P−H

- Second Set (S2 and R2): Using the full trading range:

- R2=P+(H−L)R2 = P + (H – L)R2=P+(H−L)

- S2=P−(H−L)S2 = P – (H – L)S2=P−(H−L)

- Third Set (S3 and R3): Calculated by doubling the range from the pivot point:

- R3=P+2×(H−L)R3 = P + 2 \times (H – L)R3=P+2×(H−L)

- S3=P−2×(H−L)S3 = P – 2 \times (H – L)S3=P−2×(H−L)

Trading Tool

The pivot point itself acts as a pivotal level of support or resistance, depending on market

conditions:

- In directionless markets, prices often oscillate around the pivot point until a breakout

occurs. - Breaking above or below the pivot point provides signals of market sentiment, potentially

indicating new highs or lows. - Traders commonly use these levels as exit points for trades rather than entry signals. For

instance, in an uptrend, breaking through the pivot point may prompt traders to target the

first resistance level as a potential exit point due to increased likelihood of resistance and

reversal.

Pivot points, with their derived support and resistance levels, are integral tools in technical analysis,

offering traders insights into potential price movements and strategic decision-making points in the

market.